Deadline For 1099s 2024 Employees Withholding – Federal income tax returns are due on April 15, but there are several other important dates to remember throughout the year. . Below are three sets of tax figures in 2024 that all employees should know. They relate to compensation from work: paycheck withholding, the potential need for estimated taxes, and your retirement .

Deadline For 1099s 2024 Employees Withholding

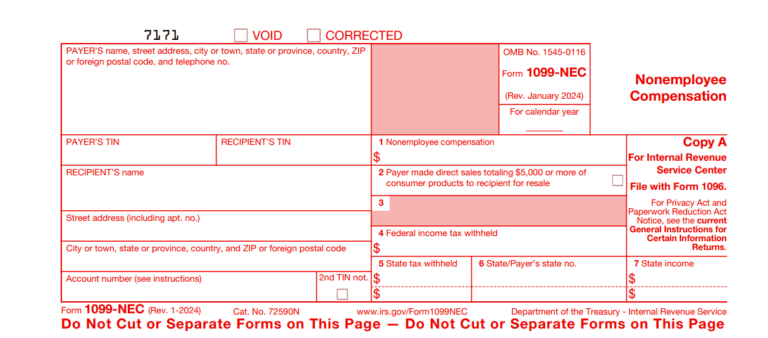

Source : apspayroll.com

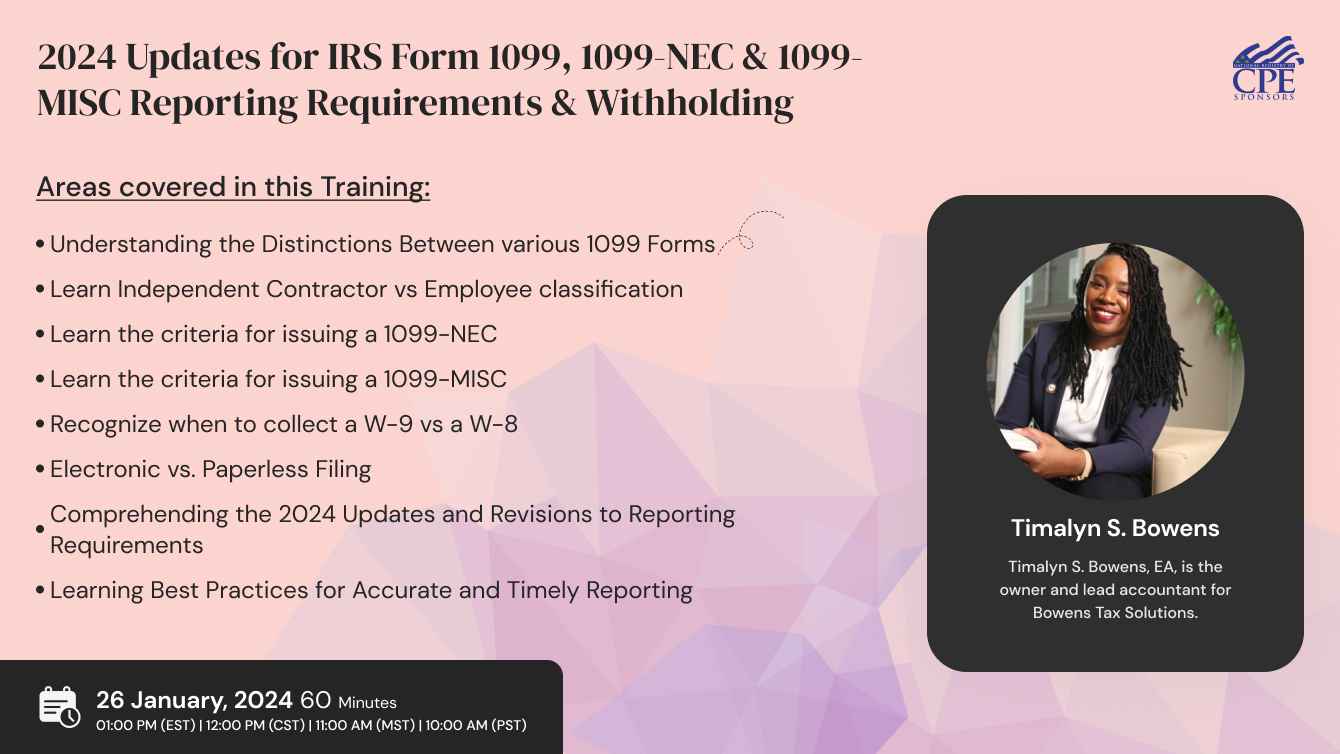

2024 Updates for IRS Form 1099, 1099 NEC & 1099 MISC Reporting

Source : clatid.io

Payroll Updates for 2024

Source : www.simonlever.com

Software | The Dancing Accountant

Source : www.thedancingaccountant.com

2024 Tax Deadlines for the Self Employed

Source : found.com

1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com

Shultz Huber & Associates, Inc.

Source : www.facebook.com

How to File 1099 NEC in 2024 — CheckMark Blog

Source : blog.checkmark.com

SBF Bookkeeping & Tax Associates Inc | Jefferson GA | Facebook

Source : m.facebook.com

2024 Payroll & 1099 Information Grimbleby Coleman

Source : grimbleby-coleman.com

Deadline For 1099s 2024 Employees Withholding What is the Difference Between a W 2 and 1099? | APS Payroll: As the calendar turns over to a new year, taxes may be the last thing on your mind. But part of your annual financial review should always include a look at upcoming tax deadlines so you can avoid . The U.S. income tax is a pay-as-you-go system. The law requires most employees and self-employed business owners to pay at least 90% of their taxes long before the April due date, which for 2023 .